![]() FDIC-Insured – Backed by the full faith and credit of the U.S. Government

FDIC-Insured – Backed by the full faith and credit of the U.S. Government

![]() FDIC-Insured – Backed by the full faith and credit of the U.S. Government

FDIC-Insured – Backed by the full faith and credit of the U.S. Government

At BankSouth, we value the trust you place in us to safeguard your money and work every day to ensure you have easy and secure access whenever you need it.

BankSouth has been helping business owners launch and grow their businesses in the community for generations. Whether you’re opening a new location or expanding your existing one, we’re ready to help.

BankSouth offers immediate and easy access to your mobile and online banking. You can also apply for and review your ReadyLoan mortgage application.

Every financial situation is unique. Explore our many resources available to you to make wise decisions when it comes to managing your money.

For over ten years, BankSouth has helped thousands of families finance their homes. We know how daunting this may be, but we take the worry and hassle out of the process.

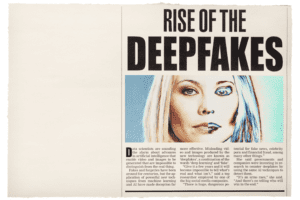

As technology continues to advance, so do the methods that scammers use to commit fraud. With the rise of artificial intelligence (AI), fraudsters are now leveraging AI and machine learning to perpetrate new types of scams, characterized by their sophistication, speed, and scalability. AI-powered fraud is a rising threat that has the potential to cause significant financial loss, reputational damage and privacy breaches. Read on as we explore AI-powered fraud including the various types of fraud, the dangers as well as the best practices for staying vigilant against it.

AI-powered fraud refers to scams facilitated by the use of artificial intelligence (AI) and machine learning. Scammers are leveraging AI to automate various aspects of their scams, such as generating fake identities, impersonating individuals and crafting targeted phishing emails. AI-powered fraud is a growing trend and has become a critical concern for individuals and businesses. Staying aware and informed about this type of fraud is crucial to protecting oneself and combating this rising threat.

Fraudsters are using AI and machine learning to perform various tasks related to fraud, such as automating phishing scams and crafting fake news articles. AI-powered fraud encompasses several different types of scams such as deepfakes, social engineering, phone scams and phishing attacks.

A deepfake, or media scam, is a highly realistic manipulated video, audio or image that depicts a person or event that never occurred. Deepfakes use a combination of artificial intelligence and machine learning techniques to generate convincing impersonations of individuals and make fictional events appear real. Deepfakes are created by training algorithms on large datasets of pictures of a particular individual, teaching the AI to learn and recognize the nuances of the individual’s facial expressions, voice, and mannerisms. Then, the AI can manipulate videos or audio by swapping faces or voices in a highly realistic way. This technique allows fraudsters to create convincing impersonations of individuals, making it difficult to distinguish a real video or audio clip from a fake one. The danger of deepfakes is that they can be used for identity theft, propaganda or damaging someone’s reputation, and are therefore a growing concern in the age of AI. They also present an enormous challenge to the credibility of visual and audio media as it is becoming increasingly harder to distinguish a real audio or video clip from a fake one. Deepfake examples include:

A deepfake, or media scam, is a highly realistic manipulated video, audio or image that depicts a person or event that never occurred. Deepfakes use a combination of artificial intelligence and machine learning techniques to generate convincing impersonations of individuals and make fictional events appear real. Deepfakes are created by training algorithms on large datasets of pictures of a particular individual, teaching the AI to learn and recognize the nuances of the individual’s facial expressions, voice, and mannerisms. Then, the AI can manipulate videos or audio by swapping faces or voices in a highly realistic way. This technique allows fraudsters to create convincing impersonations of individuals, making it difficult to distinguish a real video or audio clip from a fake one. The danger of deepfakes is that they can be used for identity theft, propaganda or damaging someone’s reputation, and are therefore a growing concern in the age of AI. They also present an enormous challenge to the credibility of visual and audio media as it is becoming increasingly harder to distinguish a real audio or video clip from a fake one. Deepfake examples include:

Phishing attacks are a type of social engineering scam where fraudsters trick people into revealing sensitive information, such as login credentials, credit card numbers or personal identification details. Phishing attacks typically involve sending fraudulent emails or text messages that appear to be from a legitimate source, such as a bank or social media platform. The emails or messages often contain urgent requests or warnings to encourage the victim to click on a malicious link or download an attachment that contains malware. The fraudster then uses the obtained information for financial gain or identity theft. There are numerous types of phishing attacks.

Pretexting is where a person poses as a trusted source to obtain sensitive information, such as account numbers or passwords. This usually takes place over the phone, where the attacker pretends to be from a seemingly legitimate company and tries to trick the user into revealing the information.

Baiting involves offering something desirable to lure in the victim, such as a free software or movie download. The content usually contains malware, which can be used to steal sensitive data.

AI is utilized for social engineering by enabling fraudsters to generate targeted and personalized phishing emails and messages that are more convincing to the intended victims. AI algorithms can use machine learning and natural language processing techniques to analyze vast amounts of data, such as social media profiles, online purchasing history, and other personal information, to create a detailed profile of the victim. Based on this profile, the AI can generate a tailored message designed to elicit a specific response, such as revealing sensitive information or downloading a malware-infected attachment. AI can also automate these messages, allowing fraudsters to target thousands of potential victims at once.

Furthermore, AI makes it easier to impersonate trusted sources, such as a bank or a reputable organization, by mimicking their voice or communication style. This personalized and realistic approach makes social engineering attacks more successful, making it harder to detect and prevent these types of attacks.

AI-powered fraud is becoming more sophisticated and challenging to detect and prevent due to the advanced algorithms and machine learning techniques being used by fraudsters. These algorithms make it easier for the scammers to generate deepfakes and create convincing impersonations, making it hard for traditional fraud detection systems to differentiate between real and fraudulent activity. Fraudsters can also use AI to quickly adapt their scams to defend against anti-fraud measures, further complicating fraud detection and prevention. This, coupled with the ability to automate fraud activities, makes AI-powered fraud very dangerous. It continues to be a pervasive problem, and stakeholders must strive to stay ahead of emerging trends by implementing robust systems and human-led reviews to detect and prevent these scams.

Staying vigilant against AI-powered fraud requires a combination of best practices, including education, authentication, and monitoring. Individuals must be aware of the risks and techniques used by scammers to avoid falling prey to their deception. As a simple rule of thumb, individuals should be cautious of unsolicited communications, suspicious links, and requests for personal information. Implementing robust authentication and verification processes, including two-factor authentication and biometric authentication, can help prevent account takeover and identity theft. Monitoring and analyzing data for suspicious patterns or anomalies can help organizations detect fraudulent activity in real-time.

If interested in more specific recommendations for avoiding scams, read on as we provide our top tips for avoiding each type of fraud explained above.

By following these steps, you can help identify and avoid deepfake scams. However, it is important to remember that technology is always evolving, and new techniques and tactics may be developed by fraudsters at any time. Therefore, it is important to stay informed and be vigilant to these potential threats.

By staying vigilant and following these guidelines, you can avoid becoming a victim of social engineering scams. Additionally, it’s recommended to educate family, friends, and coworkers about these types of scams, help them recognize the signs, and encourage them to be equally cautious.

AI-powered fraud is a real and growing threat that demands our attention and effort to combat. The rise of AI-powered scams has made scammers more sophisticated in their tactics and as a result, traditional countermeasures may no longer suffice to detect and prevent them. Staying informed, vigilant, and updated on emerging trends and adopting a collective effort in preventing and reporting fraud can significantly reduce the risks of falling prey to AI-powered scams. With the right education, training, and measures in place, we can protect ourselves and our organizations from financial loss, reputational damage, and privacy violations while harnessing the potential benefits of AI.

We at BankSouth encourage everyone to be proactive in staying ahead of the curve when it comes to AI-powered fraud, and together, we can work towards a safer digital future! In our help section, you can also find additional resources for avoiding scams, how to report scams, and scams that have been recently attempted against our customers.

View our latest news and get the latest industry updates on our blog.