![]() FDIC-Insured – Backed by the full faith and credit of the U.S. Government

FDIC-Insured – Backed by the full faith and credit of the U.S. Government

![]() FDIC-Insured – Backed by the full faith and credit of the U.S. Government

FDIC-Insured – Backed by the full faith and credit of the U.S. Government

Made with students and young adults in mind.

Banking made easy. Easy access and no fuss.

Start out on the right financial foot. Open a Young Adult checking account online or in-person.

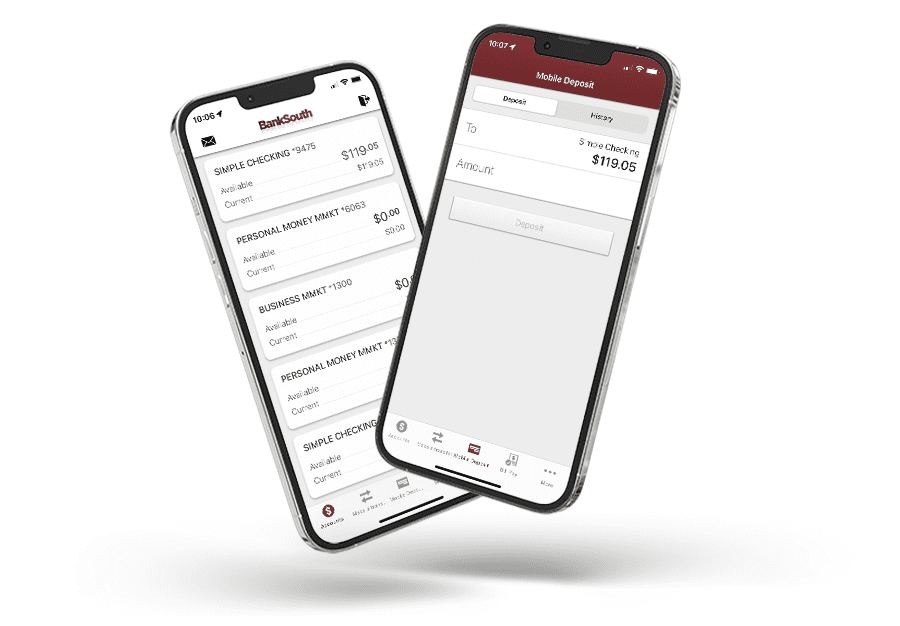

Manage your Young Adult checking account online and on your phone. With our easy-to-use online personal banking technology, you can:

It’s easy to enroll, easy to use, and fully secure. It’s your local bank available from your fingertips.

1 We charge an overdraft fee of $20 per overdraft which may be created by automatic bill payments, checks, and other transactions using your checking account number. We do not authorize and pay overdrafts on ATM and everyday debit card transactions. You must repay the overdraft amount and the fee within 30 calendar days after the overdraft. Whether your overdrafts will be paid is discretionary and we reserve the right not to pay. For example, we typically do not pay overdrafts if your account is not in good standing, you are not making regular deposits, or you have too many overdrafts. 2Fee charged by BankSouth is waived on up to four (4) withdrawals per statement cycle. Up to $12 will be refunded at the end of each statement cycle for ATM surcharges charged by owners of non-BankSouth ATMs. 3BankSouth Standard WOX checks (Wallet Oxford), basic BankSouth check with logo as the watermark.

Message and data rates may apply when using the BankSouth mobile app.