![]() FDIC-Insured – Backed by the full faith and credit of the U.S. Government

FDIC-Insured – Backed by the full faith and credit of the U.S. Government

![]() FDIC-Insured – Backed by the full faith and credit of the U.S. Government

FDIC-Insured – Backed by the full faith and credit of the U.S. Government

Make your money work harder and earn more* with our high-yield checking account.

Open a Performance Checking Account

*Conditions apply.

To receive the premium interest rate2, all of the following requirements must be met in each statement (qualification) cycle:

Ready to let your money perform for you?

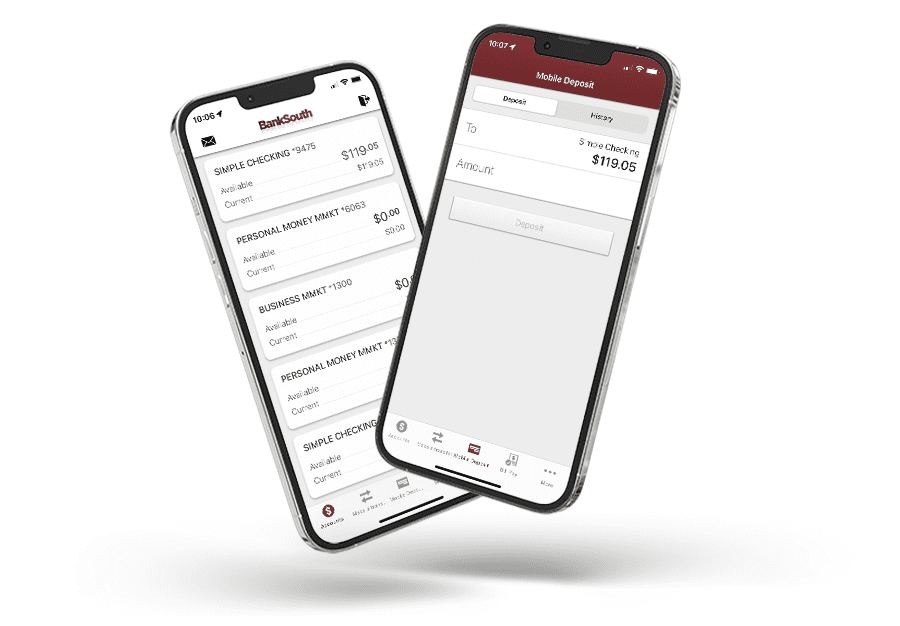

We’re local – and everywhere you need us to be. Manage your Performance checking account online and on your phone. With our easy-to-use online personal banking technology, you can:

It’s easy to enroll, easy to use, and fully secure. It’s your local bank available from your fingertips.

1 We charge an overdraft fee of $20 per overdraft which may be created by automatic bill payments, checks, and other transactions using your checking account number. We do not authorize and pay overdrafts on ATM and everyday debit card transactions. You must repay the overdraft amount and the fee within 30 calendar days after the overdraft. Whether your overdrafts will be paid is discretionary and we reserve the right not to pay. For example, we typically do not pay overdrafts if your account is not in good standing, you are not making regular deposits, or you have too many overdrafts.

2 Rates are accurate as of December 23, 2025. The Performance Checking Account is a tiered rate account with the stated interest rate for each tier paid on the portion of the account balance within each tier. Balances up to and including $24,999.99 will earn an interest rate of 2.20% and 2.22% APY (Annual Percentage Yield) if qualifying conditions have been met for that monthly statement cycle. The annual percentage yield for balances $25,000 and over ranges from 2.22% APY to 1.86% APY (based on assumed range of balances from $25,000.00 to $30,000.00). Should you fail to meet the monthly qualifying conditions for the Performance rate, all balances in the account for that month will earn 0.05% APY. Fees may reduce earnings. Rates may change after account opening at bank’s discretion.

Message and data rates may apply when using the BankSouth mobile app.