![]() FDIC-Insured – Backed by the full faith and credit of the U.S. Government

FDIC-Insured – Backed by the full faith and credit of the U.S. Government

![]() FDIC-Insured – Backed by the full faith and credit of the U.S. Government

FDIC-Insured – Backed by the full faith and credit of the U.S. Government

At BankSouth, we value the trust you place in us to safeguard your money and work every day to ensure you have easy and secure access whenever you need it.

BankSouth has been helping business owners launch and grow their businesses in the community for generations. Whether you’re opening a new location or expanding your existing one, we’re ready to help.

BankSouth offers immediate and easy access to your mobile and online banking. You can also apply for and review your ReadyLoan mortgage application.

Every financial situation is unique. Explore our many resources available to you to make wise decisions when it comes to managing your money.

For over ten years, BankSouth has helped thousands of families finance their homes. We know how daunting this may be, but we take the worry and hassle out of the process.

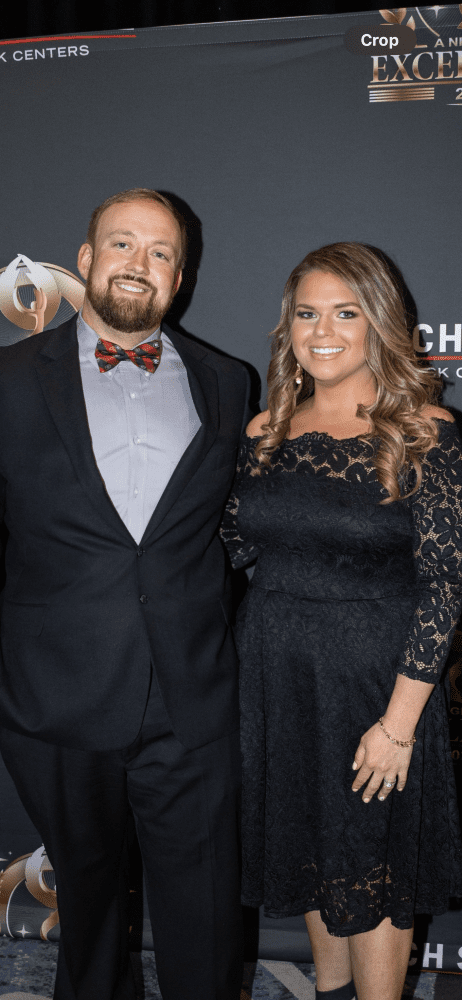

With more than 15 years in the banking industry and over a decade as a trusted loan officer, Victoria Liebl combines deep financial expertise with a genuine passion for helping people achieve their homeownership and financial goals. Her journey in real estate began early—she purchased her first home at just 21—and that passion has only grown as she continues to guide others through one of life’s biggest milestones.

Most recently, Victoria completed the exciting process of building her own home, giving her unique, up-to-date insight into what clients can expect when navigating new construction. Whether you’re buying your first home, building your dream home, or refinancing, Victoria is committed to providing the personalized support and practical guidance you need to move forward with confidence.

Victoria is a proud graduate of the University of Georgia with a degree in Consumer Economics, as well as a graduate of the Georgia Bankers Association’s three-year Banking School—demonstrating her dedication to ongoing professional growth and excellence in service.

Contact Victoria to learn more about how she can assist you with your banking and lending needs.